As per recent reports, the tax authorities in India are scrutinizing 89 high-risk foreign remittance cases for suspected tax evasion.

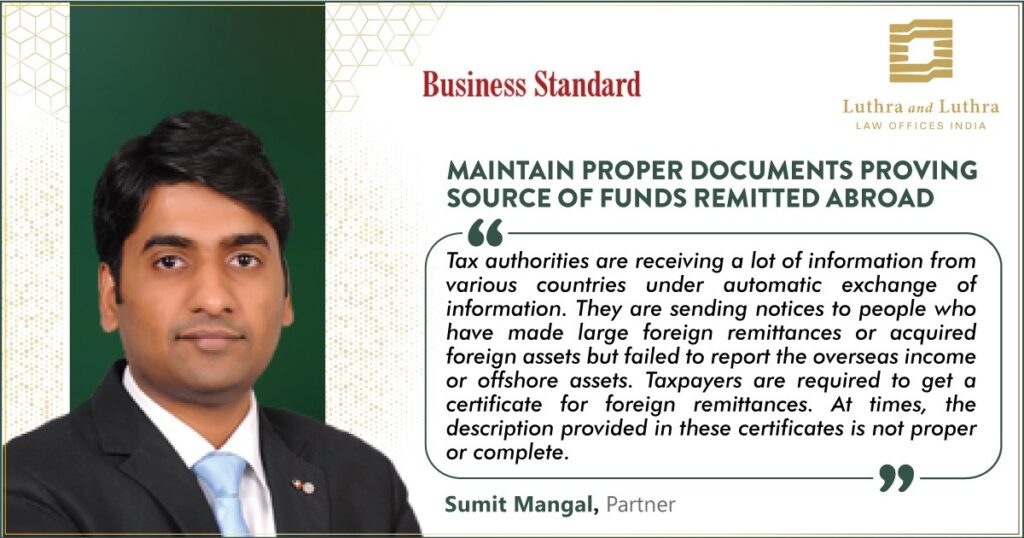

To shed some light on this issue, Partner, Sumit Mangal answers some essential questions in a story titled – “Maintain proper documents proving source of funds remitted abroad”, covered by Business Standard.

The story covers the following –

1. Under what circumstances do people usually come under the taxman’s lens?

2. What are some of the precautions one should exercise to avoid coming under scrutiny when remitting money abroad?